The U.S. national debt has just blown past $37 trillion, a milestone the Congressional Budget Office once predicted would not arrive until 2030. It is here five years early.

And yes, there is still an official U.S. Treasury page where you can voluntarily donate to help pay it down:

👉 https://www.fiscal.treasury.gov/public/gifts-to-government.html

Credit card, check, Apple Pay, just like buying something on Amazon, except here you are bailing out the richest country in the world while billionaires keep their money.

If that sounds absurd, it is. Ordinary Americans, already paying taxes on every paycheck and every purchase, are told to dig deeper to “save” the country. The people who could actually make a dent in this debt, the billionaires and corporate giants who have extracted the most from the system, remain untouched.

The New Numbers: Debt and Interest Spiral

Debt now equals 123 percent of U.S. GDP, well past the IMF’s recommended 100 percent threshold for advanced economies. In just the first 10 months of this fiscal year, the U.S. has racked up a 1.629 trillion dollar deficit, 7.4 percent higher than last year.

The interest bill is exploding. For fiscal 2024, net interest costs hit 1.133 trillion dollars, up 29 percent in one year, surpassing total defense spending and Medicare combined. Interest alone now consumes 18.7 percent of all federal revenue, far above international warning lines.

Bridgewater’s Ray Dalio calls it a “death spiral.” Bigger deficits force the Treasury to sell more bonds. Rising debt makes those bonds riskier. Investors demand higher yields. Higher yields push interest costs up even faster. The U.S. is now borrowing to pay interest on old borrowing, a feedback loop with no exit strategy.

Who Could Actually Make a Dent

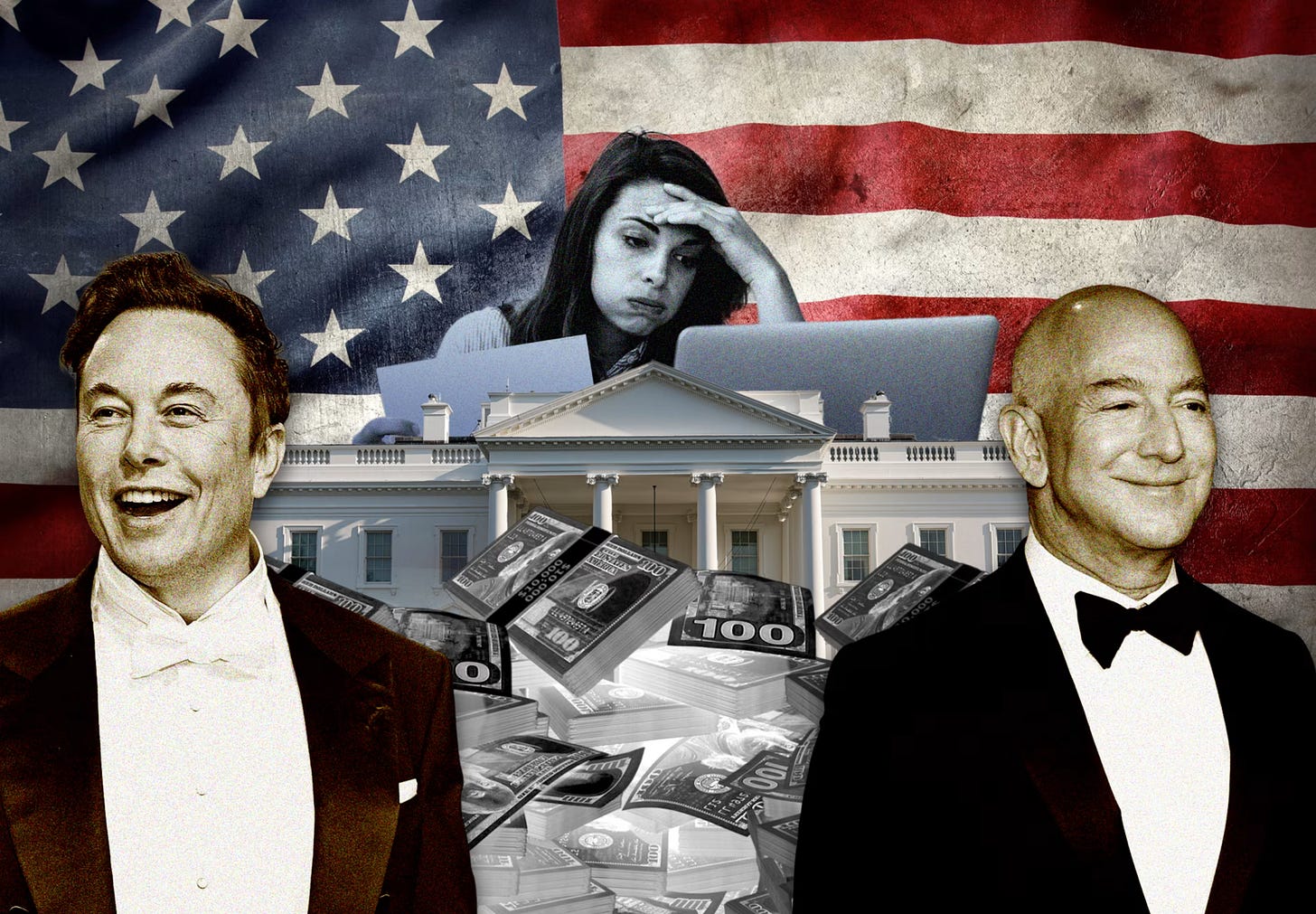

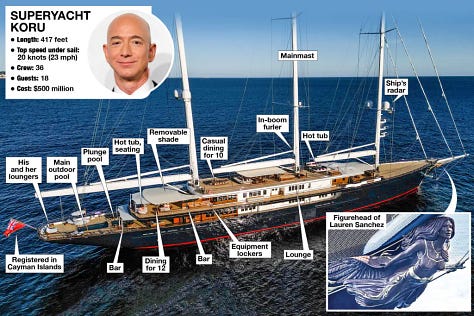

America’s richest individuals have personal fortunes that dwarf the GDP of small nations. Elon Musk’s wealth hovers around 380 to 400 billion dollars. Mark Zuckerberg’s is about 270 billion. Jeff Bezos has roughly 250 billion. Larry Ellison sits near 295 billion. Warren Buffett has about 160 billion. Together, the top five control roughly 1.3 trillion dollars, about 4 percent of the national debt.

And then there are the corporate behemoths. Microsoft’s market value is about 3.9 trillion dollars, Amazon’s about 2.3 trillion, and Palantir’s about 370 billion. Combined, that is roughly 6.6 trillion dollars, close to 19 percent of the national debt. These companies operate in and profit from the U.S. system. They rely on U.S. infrastructure, contracts, subsidies, and legal protections. Without them, they would not exist at their current scale. When it comes to the debt, they give nothing.

They Could Pay, They Just Don’t

The common defense is that their wealth is “tied up” in stock, not cash. This is misleading. Billionaires sell shares regularly to fund pet projects, charitable foundations, and stock buybacks. Microsoft, Amazon, and other tech giants hold hundreds of billions in cash reserves, enough that a one percent contribution toward debt reduction would not even register on their balance sheets.

Some fortunes were built directly on government money. Palantir’s entire business model revolves around U.S. defense contracts funded by taxpayers. Defense contractors like Lockheed Martin and Raytheon feed off massive Pentagon budgets, budgets that are themselves financed by government borrowing.

The Tariff Sleight of Hand

Trump’s chaotic “reciprocal” tariff policy was pitched as a way to help fill the debt hole. In reality, tariffs are import taxes paid by importers, who pass the costs down to you at the cash register.

In July, tariff revenue hit 28 billion dollars, a historic high and a 273 percent jump from last year. That revenue bump has not stopped deficits from widening. Retaliatory tariffs from other countries have hit U.S. exports, pushing up domestic prices and feeding inflation.

If tariffs are really for debt reduction, why not make the richest pay their share? They do not need another yacht. They do not need hundreds of millions for private space tourism. They could direct a fraction of that wealth toward the debt without any real impact on their lifestyles.

The Patriotism Scam

These billionaires love to call themselves patriots. They do not love America as a shared national project, they love the American system:

Weak unions that keep wages low.

Weak tax enforcement that allows offshore shelters.

Endless military spending that guarantees contracts.

Media narratives that protect them from scrutiny.

Your role is to work, pay taxes, and accept that the system was never designed with your prosperity in mind. In the government’s eyes, you are a revenue stream. In the billionaire’s eyes, you are a wage slave.

Why They Won’t Pay

When challenged, the wealthy say they already pay taxes and create jobs. They argue government mismanagement, not their inaction, is the real problem. They warn that taxing them more would harm investment.

These arguments do not hold up. Many billionaires pay a lower effective tax rate than middle-class workers due to loopholes and the special treatment of capital gains. The jobs they create are often low-wage, unstable, and heavily subsidized by taxpayers through welfare programs for underpaid employees. Calling for proportional contributions during a national crisis is not confiscation. It is the same principle that allowed America to win World War II, when the top marginal tax rate exceeded 90 percent and the economy still boomed.

The Bigger Picture

Since the 1980s, U.S. fiscal policy has been built on “borrow now, pay later.” In the last 50 years, there have been only four years of federal surplus, the last in 2001. Today, it takes just months for the debt to grow by one trillion dollars.

Military spending remains a constant drain, up 53.3 billion in 2024 alone, consuming 13 percent of the federal budget. The political cycle ensures neither party wants to slam the brakes. Both prefer tax cuts and higher spending to please voters and donors.

The debt burden has already cost the U.S. its final AAA credit rating. In May, Moody’s downgraded U.S. sovereign debt to Aa1, citing fiscal deterioration and massive tax cuts. With all major rating agencies now off AAA, the “risk-free” status of U.S. debt is eroding.

Globally, this feeds a wave of de-dollarization. From Latin America to Africa, the Middle East, and Asia, countries are shifting away from the dollar, a trend accelerated by U.S. tariff volatility and sanctions policy.

The Bottom Line

The U.S. government is effectively asking working Americans to donate through a Treasury website, pay higher prices via tariffs, and accept cuts to services, while billionaires and corporate giants, the biggest beneficiaries of the American system, continue business as usual.

This is not a sign of a broken system. It is proof the system is working exactly as designed, for them, not for you.