1) What the Common Dreams article actually says

Common Dreams highlights a basic contradiction in the latest U.S. economic numbers. The government reported GDP growth of more than 4 percent in the third quarter of 2025, and Trump allies used it as a headline victory. But the people digging into the details argue the headline is hiding the real story: the economy is split, and most of the gains are not reaching ordinary workers.

The article cites comments from journalists and economists who say growth is being driven largely by high-income households, while lower-income households are leaning more heavily on debt and payment plans to get through normal spending.

2) GDP is not your paycheck

GDP measures total output. It does not measure how income is distributed. That sounds obvious, but it matters because politicians love to blur the line.

When an official implies “GDP rose 4.3%, so Americans will earn 4.3% more,” that is not economics. That is messaging. GDP can rise even if wages stay flat, purchasing power falls, and debt rises. In fact, that combination is common.

3) The “split economy” in plain language

A key detail in the reporting is that the top part of the income ladder is carrying a huge share of consumer spending. If growth depends heavily on the top 20 percent, that means the economy can look strong even while most households are cutting back.

This is what a split economy looks like. It is not one America. It is at least two, living on different rules.

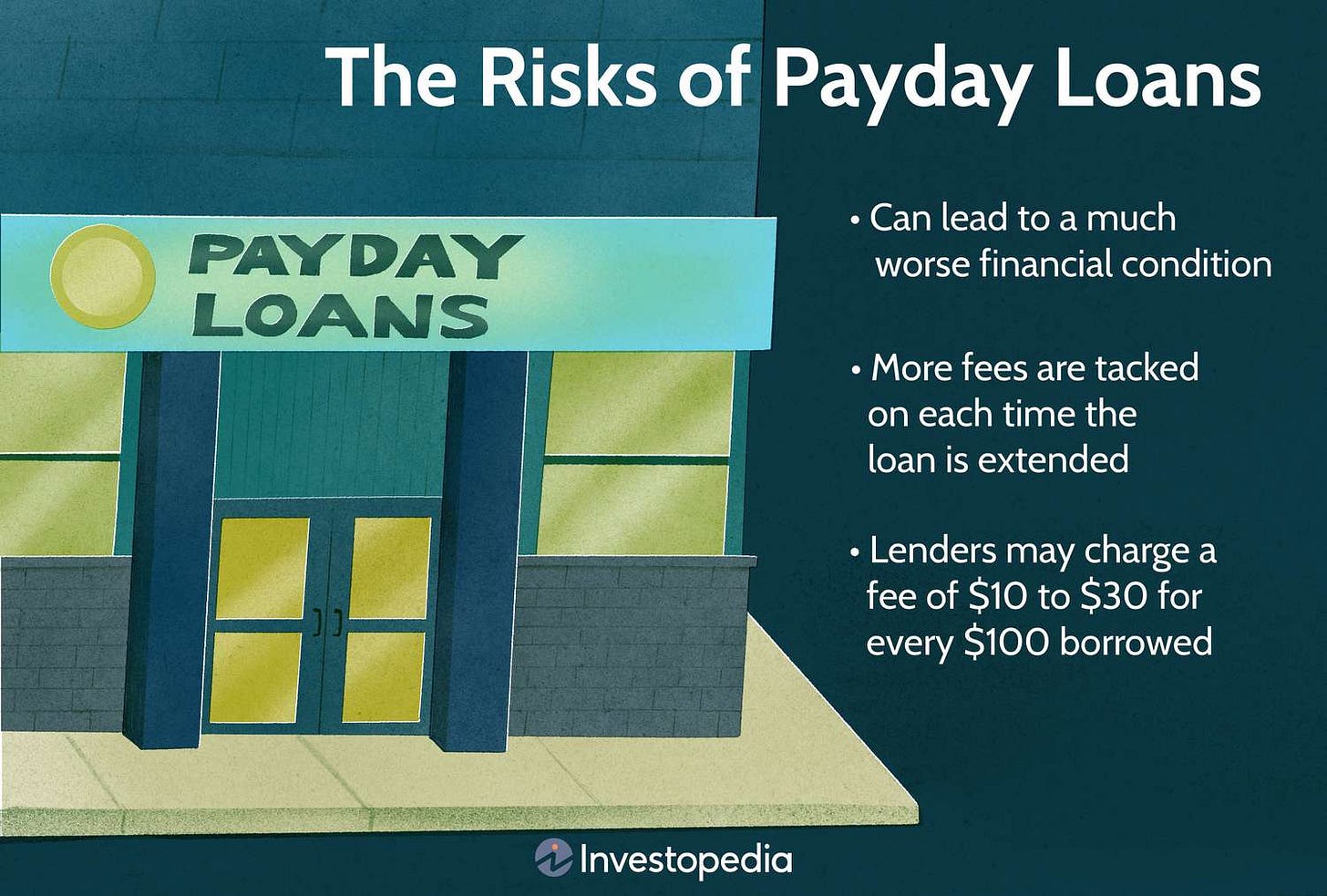

4) Buy-now-pay-later is not confidence. It is pressure

One of the sharpest signals in the article is how lower-income consumers are paying for basic seasonal spending. A large share are using buy-now-pay-later services.

For higher-income households, payment plans can be a convenience. For lower-income households, it is often a patch for a cash-flow problem. It is not “smart spending.” It is survival spending.

This is where the line fits: it is very expensive to be in the pool. Staying afloat costs money. If wages do not cover life, the system offers debt as the substitute.

5) Why workers feel stuck even when the headline says “hot economy”

The article also points to a labor market problem that gets ignored when people only look at GDP. Job switching has slowed and opportunities feel harder to reach. When workers cannot easily move, they lose bargaining power. When bargaining power falls, wage growth weakens.

That produces a familiar outcome: the economy grows, profits grow, asset prices grow, but paychecks do not keep up.

6) Why public mood looks worse than the official numbers

This is why polls can look negative even during “good” GDP quarters. People are not confused. They are responding to rent, food, insurance, and debt. Those are daily costs, not abstract averages.

When growth is concentrated at the top, the majority experience the economy as stress, not success.

7) The point is bigger than Trump

It is easy to turn this into a simple partisan story. That is also a trap. The deeper issue is structural.

If growth repeatedly rewards capital faster than labor, and if household stability increasingly depends on borrowing, then you can get strong GDP numbers while living standards stall for the working class.

Closing

GDP growth is real. So is the strain people feel. The contradiction is not emotional. It is structural.

It is very expensive to be in the pool. The real question is not whether the economy is growing. It is who can still afford to stay in the water.