When Billionaires Threaten to Leave, Who Are They Really Blackmailing?

A temporary California billionaire tax is pitched as a healthcare backstop during Medicaid cuts. Peter Thiel’s reaction exposes a deeper power problem.

1) What the news is actually about

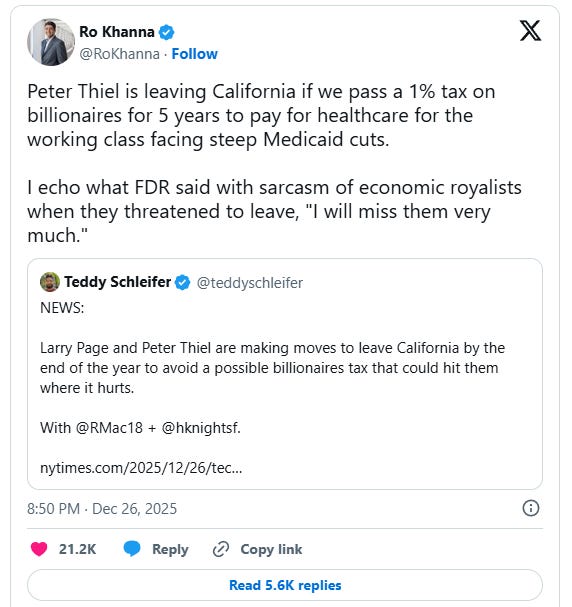

Peter Thiel is in the news because of a proposed California ballot initiative that would create a temporary wealth tax on billionaires. Supporters argue the money would help protect healthcare as Medicaid faces cuts and California risks losing billions in federal funding. The campaign is currently in the signature-gathering phase, but the debate is already intense because some billionaires are reportedly discussing leaving the state if the measure advances.

2) What the ballot measure would do

The proposal targets residents with net worth above $1 billion. The headline number is a 5% wealth tax, and it’s commonly described as 1% per year for five years. It would apply based on residency on January 1, 2026, and payments could be spread out over time. It’s not permanent, and it’s designed to hit the very top, not ordinary high earners.

3) Why Peter Thiel matters in this story

Thiel is not just another wealthy Californian. He co-founded PayPal and leads Palantir, a company whose business is deeply tied to government contracts, including defense and national security systems. He has also been a major figure in Silicon Valley political circles for years, and he has backed J.D. Vance politically. That context matters because it turns this from a basic tax fight into a power question: someone who profits from government pipelines is threatening to cut ties when asked to contribute back to the public.

4) The moral issue is simple

These billionaires made their fortunes inside a system that depends on public stability: infrastructure, courts, schools, universities, legal protections, and the talent pipeline that makes tech and finance possible. They benefited from the state whether they admit it or not. Then a temporary tax appears to help protect healthcare for working people, and the response is: “Tax me and I’ll leave.”

That’s not principle. That’s leverage.

Working families don’t have that option. They can’t opt out of rent. They can’t opt out of medical bills. They can’t opt out of a bad year. Billionaires can move money and residency like it’s a strategy. For them, social responsibility becomes optional.

5) California government is not off the hook

Even if you agree with taxing billionaires, California still has to pass a second test: competence. If the state collects this money, it has to use it well and show results that people can feel. If the revenue gets absorbed by bureaucracy, slow rollouts, and sloppy execution, public trust collapses fast. And once trust collapses, billionaires get the easiest talking point in the world: “See? Government wastes everything.”

So yes, tax the billionaires. But also demand measurable delivery.

6) The question that actually matters

If a billionaire can threaten to leave to avoid contributing, then what does that say about who government is working for?

And if California can’t prove it can turn new revenue into real healthcare outcomes, what exactly is the public being asked to believe in?

More stories here,

Thanks Neil. Seriously, these guys (mostly) have multiple private jets, superyachts, private islands and multiple properties globally. The notion that they spend substantial time in any single tax jurisdiction is laughable.

Yo, Pete; don't let the door hit you in the ass on the way out. Oh, wait a minute! (cuing-up fat masked men in tac gear) Step over here. (barring exit to private jet otherwise bound for New Zealand)

Agent Robespierre wants to talk to you.