The 50-Year Mortgage: A Debt Trap Disguised as Housing Relief

How Trump’s plan to “make housing affordable” only deepens America’s debt crisis

Trump’s “Big Idea”

Donald Trump says he wants to help young Americans buy homes by creating a 50-year mortgage. He even compared himself to FDR, who introduced the 30-year mortgage after the Great Depression. It sounds patriotic, like history repeating itself for a new generation, but the math tells a very different story.

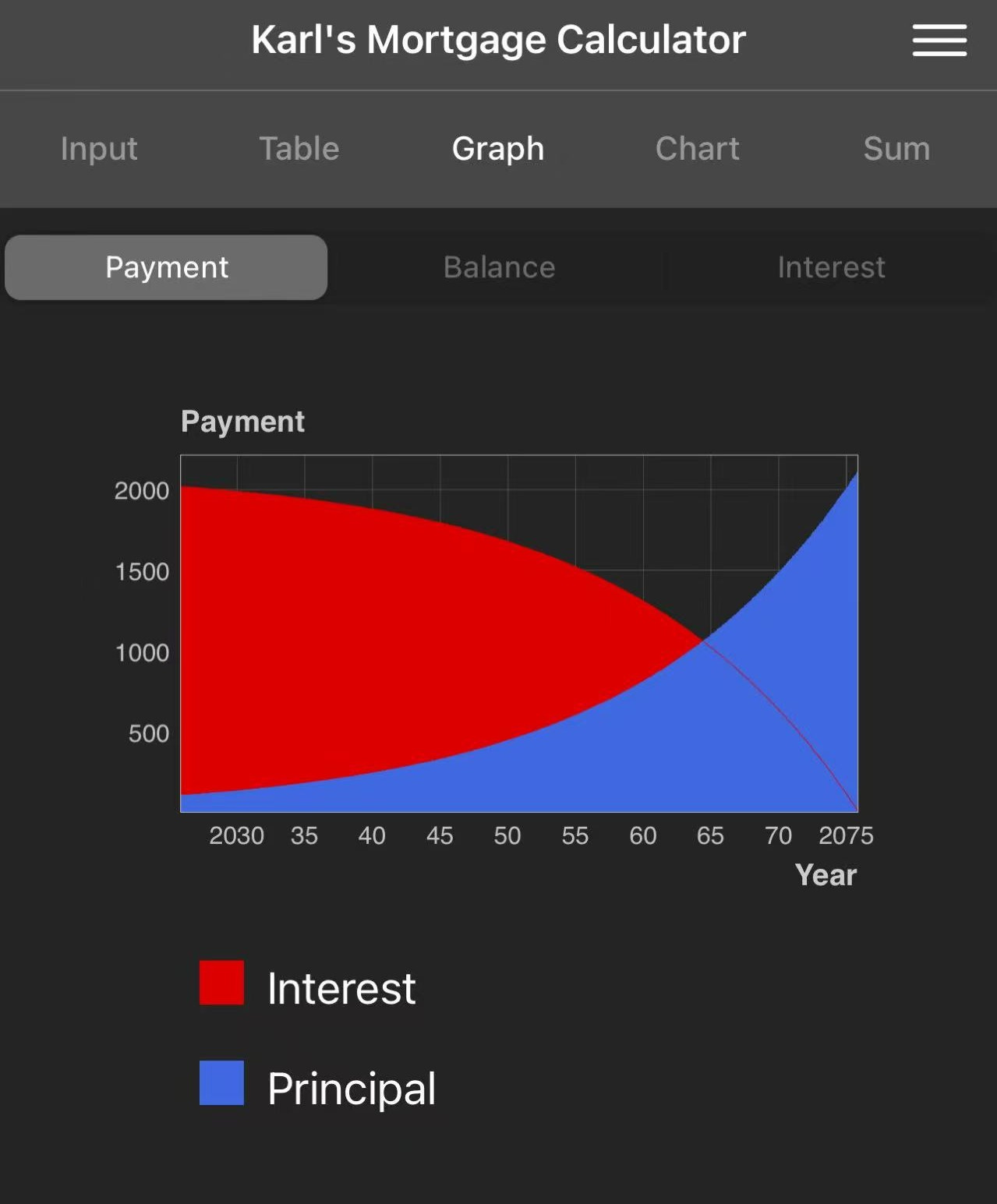

If you buy a $500,000 home with a 20 percent down payment, you’re borrowing $400,000 at 6.125 percent interest.

On a 30-year loan, your monthly payment is about $2,410.

You’ll pay $467,000 in interest.On a 50-year loan, your monthly payment drops slightly to $2,119.

You’ll pay $871,000 in interest over time.

So you save less than $300 a month, but you hand the bank an extra $404,000 and two extra decades of your life.

That’s not affordability. That’s a lifetime contract with Wall Street disguised as generosity.

The Real Numbers

The numbers tell the story.

The median home price in the United States is now over $420,000.

The average mortgage rate is around 7 percent.

About 65 percent of Americans own their homes nationwide.

In major cities, that figure drops to around 50 percent.

That means half of urban residents don’t own the homes they live in, and many of those who do are sending most of their payments to cover interest, not principal. In other words, they’re not building equity. They’re building the bank’s profit.

Now imagine what happens if 50-year loans suddenly become easy to get. That’s the idea, to make it “accessible” for younger buyers who can’t afford today’s prices. But when you increase demand without increasing supply, prices spike. If everyone suddenly qualifies for a mortgage but there aren’t enough houses to buy, the market overheats. Demand rises, supply stays low, and prices skyrocket. Developers, investors, and banks celebrate. Working people lose again.

And here’s the cruelest part. With a 50-year amortization period, the first 15 to 20 years of payments are mostly interest. The money you pay each month doesn’t build real equity. The principal reduction is minimal. You’re not building an asset. You’re just renting from the bank while thinking you’re buying. It’s ownership in name only, financial servitude dressed up as the American dream.

The Real Solution

The solution to America’s housing crisis isn’t to stretch debt longer. It’s to build more housing. Build homes, build infrastructure, and build affordable communities where people can actually live, not just speculate. The country doesn’t have a mortgage problem. It has a supply problem.

For decades, restrictive zoning laws and speculative investment have inflated prices far beyond the reach of working families. Developers prioritize luxury condos over starter homes because the profit margins are higher. Hedge funds scoop up entire neighborhoods and rent them back to the same people who can no longer afford to buy. The system is built to reward scarcity, not stability.

A 50-year mortgage doesn’t challenge that system. It protects it. It hides the structural shortage behind longer loans and softer monthly payments, allowing prices to stay inflated while keeping people in debt for life. The government gets to say it “expanded access,” and banks get another generation of guaranteed income. Everyone wins except the people trying to live somewhere.

From a Real Estate Professional

I’ve worked in real estate for almost 15 years, and I’ve seen what happens when people push themselves too far trying to buy a home they can’t afford. Society teaches them that renting means failure, that homeownership equals success, and that any debt is worth it if it buys a house. That mindset ruins lives.

If you can’t afford a house right now, don’t force it. Don’t stretch your finances thin just to keep up with an illusion. Move somewhere more affordable, save your money, and when the time is right, buy smart. Take a shorter loan. Pay it down fast. Don’t let the bank own your next 50 years just so you can say you own a roof.

And please, stop chasing lifestyles you can’t afford. I’ve done it the hard way. I saved, I worked, and I eventually bought my home. What I learned is that the real dream isn’t ownership. The real dream is freedom. Financial freedom means peace, not pressure. A home should give you security, not servitude.

Final Take

The 50-year mortgage isn’t a path to opportunity. It’s a financial trick designed to keep people working for banks until the end of their lives. It doesn’t help young Americans. It helps lenders extract more money from them.

Real housing relief won’t come from new loan terms. It will come from construction, from policy, and from leadership that values housing as a necessity, not an investment product. The United States doesn’t need longer debt. It needs more homes.

Because if you owe for 50 years, you don’t own the house.

The bank owns you.

Closing Thought

A country led by capitalists can only think of using capitalism to govern itself. In the end, all it knows how to do is extract the surplus value of working people.

It’s also an effective method of control: people whose housing is tied into a loan must maintain their income level to be able to afford to keep that home and interest rates can be used to threaten that and make it more difficult. One of the main ways to bring about positive change is to withdraw one’s labour by going on strike, but then there is no income and the system is designed to make you homeless when that happens. Hence people cannot afford to take action without the threat of losing their housing. This obviously applies to renting too and in both instances people are at the mercy of those who own either the debt or the building. Banks and corporate landlords are only interested in profit, so most people are tied into the system unless they have paid off their mortgage- therefore the longer it runs, the more control they have. Also, the decreasing US life span (due to the appalling US diet which is heavy in animal product and highly processed fatty, sugar laden products and low in essential fiber), most people won’t live long enough to pay a 50 year mortgage off, will die in debt and the banks will seize the housing.

Build more housing competently, and revive / restore existing housing. Expel hedge fund money from the process. Use public funds; implement public policy, like, for instance: "Thou shalt not build / fix up this building with public subsidy without a solar generative roof